Property Taxes Now Easier to Challenge

June 4th, 2009 by Mike VasilindaIf you own a home or business and disagree with the value assigned by the property appraiser, your chances of winning an appeal are about one in ten. Legislation signed today will increases your chance of winning in the future, but as Mike Vasilinda tells us, it comes at a cost to local governments.

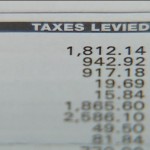

Property tax notices go out in August. Until now, the value put on your home or business has been presumed be correct by law. But with the stroke of his pen, Governor Charlie Crist changed the presumption of correctness and made it easier to challenge your assessment.

“This bill ensures that if the tax payer can provide more convincing evidence than the property appraiser can, that the home will receive a modified, hopefully reduced, assessment,” Crist said.

Statewide, more than a hundred thousand challenges were made last year. Half were of them made in Miami-Dade were successful, but in most other counties, the success rate was far, far less.

“The presumption of correctness issue which was addressed in this legislation, weights the situation very heavily in favor of the property appraiser,” tax attorney Ben Phipps said. “It makes it very difficult for the taxpayer to prevail.”

While the number of reductions being granted statewide varies from county to county, the statewide average of each is over 167 thousand dollars. And that suggests businesses, not homeowners, are reaping the benefits.

Property appraisers fought the change. They say it will hurt small counties and help big business.

“So its no-lose situation for the business to say, ok challenge it,” Leon property appraiser Bert Hartsfield said. “Whether it’s fair or not doesn’t come into the picture. It’s an issue of if I’m successful, I’ll make money at it.”

Because more successful challenges are expected, estimates suggest that local governments will lose more than a half a billion a year by 2013.

Posted in Charlie Crist, Housing, Property Taxes, State News |  No Comments »

No Comments »